Condo Insurance in and around Longmont

Welcome, condo unitowners of Longmont

Insure your condo with State Farm today

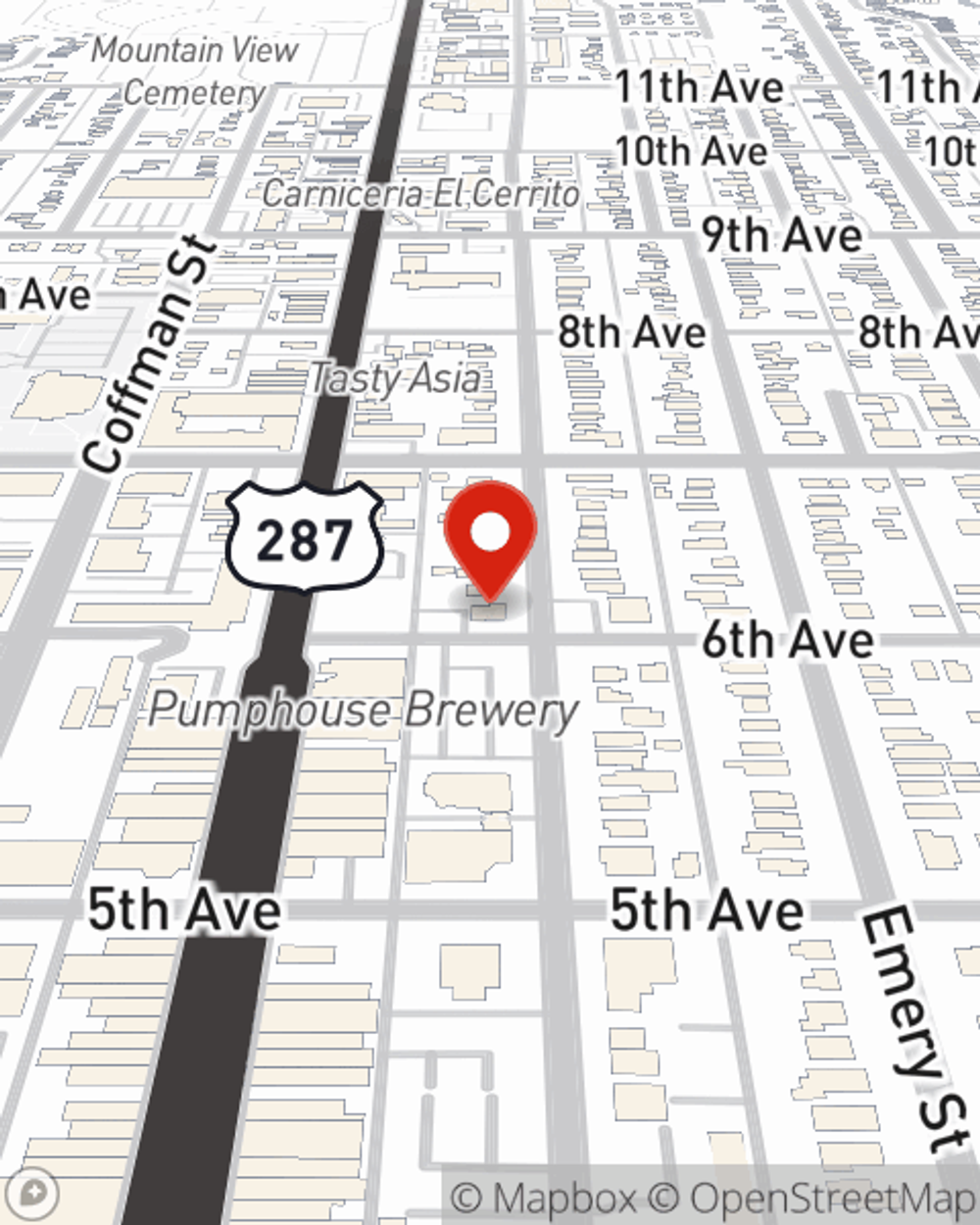

- Longmont

- Niwot

- Frederick

- Firestone

- Platteville

- Mead

- Erie

- Lyons

- Boulder

- Gunbarrel

- Dacono

- Louisville

- Berthoud

- Greeley

- Loveland

Calling All Condo Unitowners!

Owning a condo is a lot of responsiblity. You want to make sure your condo and personal property in it are protected in the event of some unexpected trouble or mishap. And you also want to be sure you have liability coverage in case someone hurts themselves on your property.

Welcome, condo unitowners of Longmont

Insure your condo with State Farm today

Why Condo Owners In Longmont Choose State Farm

Despite the possibility of the unanticipated, the future looks bright when you have the fantastic coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your condominium and personal property inside, you'll also want to check out options for replacement costs bundling, and more! Agent Wes Parker can help you develop a Personal Price Plan® based on your needs.

If you want to learn more, State Farm agent Wes Parker is ready to help! Simply visit Wes Parker today and say you are interested in this excellent coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Wes at (303) 772-6467 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.